Exploring Blockchain Bridges: Navigating Asset Transfers Across Networks

- Published on

- Authors

- Author

- Eren Lokman

- twitter @_erenlkmn

Exploring Blockchain Bridges: Navigating Asset Transfers Across Networks

In my last article, I introduced you to the concept of blockchain bridges. At the end of that piece, I posed a question to myself and to you. Let’s revisit that question:

What happens to an artist’s royalties if you transfer an NFT, which has “Royalty” rights on the Ethereum network, to another network? 🤔

I’ve explored some answers and would like to discuss two different assessments with you:

- First, the royalty is defined on the marketplaces where artists mint their NFT artworks, and this royalty is specific to that marketplace. If the NFT is transferred via a bridge to a different network, the same situation applies to the marketplace there. We might consider this as competition between NFT marketplaces.

- Secondly, consider two different networks, each with its own NFT standard, including the creator’s addresses and their royalty percentages. Even if the token crosses between these networks via a bridge, it could still recognize the creator and continue paying royalties across different networks. This would be another solution, where it’s crucial that the addresses and royalty percentages match in the contracts that create different NFT standards.

If you have different opinions or ideas on this topic, please share them with us!

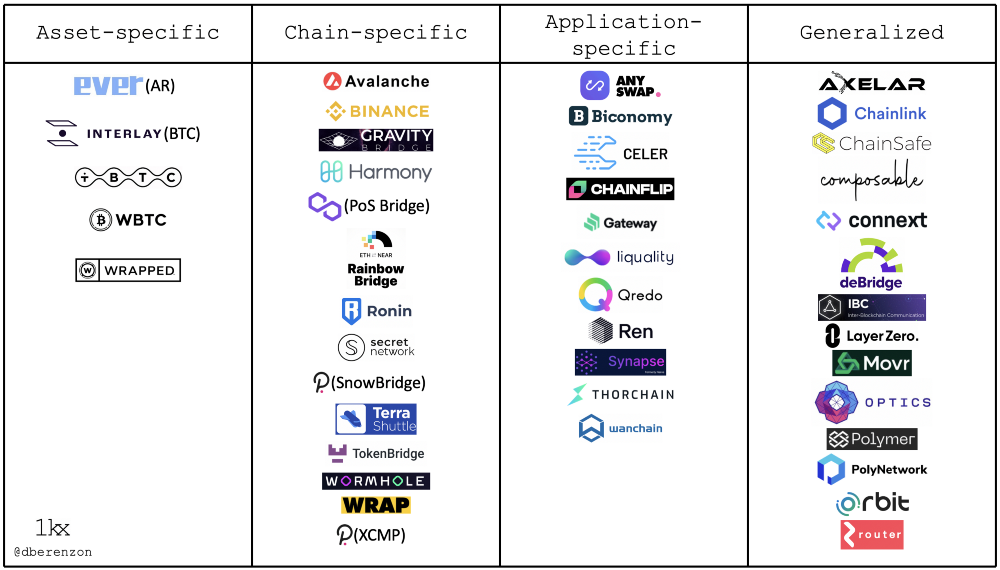

These bridges fundamentally facilitate the transfer of records stored on the blockchain, and the blockchain bridges we know and develop today can be categorized into four different groups:

Asset-Specific Bridges: These bridges enable the presence of a native currency from one blockchain on another. For example, Wrapped Bitcoin (WBTC) is an ERC-20 token on the Ethereum network that mirrors Bitcoin’s value fluctuations. You can borrow money on DeFi platforms on the Ethereum network using WBTC as collateral. You can also stake your WBTCs to generate returns.

Chain-Specific Bridges: Used for simple tasks such as locking or unlocking wrapped assets on the source blockchain. For instance, Polygon’s PoS bridge supports asset transfers between Ethereum and Polygon, but this only enables value transfers between these two chains. This use is due to scalability issues on the Ethereum network, making more scalable but secure networks like Polygon preferred (due to lower gas fees, faster transaction capabilities, etc.).

Application-Specific Bridges: These can bridge two or more networks. This type of bridge is application-based, meaning the bridges exist within applications. Examples include Compound and Thor Chain, which make lending, swapping, and other functions more usable and cost-effective.

General Bridges: Specially designed protocols for transferring information across multiple blockchains.

Blockchain bridges enable us to transition between networks without stepping outside the realm of crypto assets, solidifying the foundations of blockchain. The development and diversification of these structures are crucial for the future of blockchain.

Let’s pose another thoughtful question then;

You own an NFT on Ethereum, and you want to move it to the Solana network. You spot a bridge for the transition. During this transfer, the asset is burned on the Ethereum network and reborn on the Solana network.

How decentralized are these bridges during your assets’ transfer from one chain to another? 🌉

In our next article, we’ll delve into how these bridge transitions happen.

Wishing everyone a delightful day!